What is a Junior ISA (JISA)?

A Junior Individual Savings Account (or JISA) is a great way

to save for your child’s future. A JISA lets you contribute

up to £9,000 a year without paying any tax on the interest

and returns. Once it’s added, the money belongs to your

child, but they can only withdraw it when they turn 18.

In this guide, we explain everything you need to know

about a JISA, including some of the main benefits and

options, and whether these accounts are right for you

and your child.

Stocks and Shares ISAs usually offer higher returns on

your money than Cash ISAs, as your savings are invested

in the stock market. Instead of earning money only

through interest, gains from Stocks and Shares ISAs also

come from investment growth (i.e., how well your stocks

and shares are performing). However, that means that the

value of your child's investments can go down as well as

up, unlike a Cash ISA.

What is a Junior ISA (JISA)?

A Junior ISA account is a tax-efficient savings

account for UK residents under 18 years old.

They work similarly to adult ISAs, letting you save

money without paying capital gains or income tax on

any interest or returns your child receives. But the

obvious difference is that JISAs are only for people

who are not yet of adult age and must be opened by a

parent or legal guardian.

Once opened, the money belongs to the child. This

means you as a parent can pay money in (up to the

annual JISA allowance of £9,000) but you can’t make

withdrawals.

Once your child turns 16, they can take control of

the account and add money if they want to. They

won’t be able to withdraw funds until they’re 18,

though. At this age, their JISA will automatically

convert into an ISA and they can transfer or

withdraw funds as a lump sum.

Just like an adult ISA, Junior ISAs are protected

(up to £85,000) by the Financial Services

Compensation Scheme (FSCS). As long as your provider

is registered with the Financial Conduct Authority,

like APL, their money is protected in the unlikely

event that their provider encounters any financial

problems.

There are two main types of Junior ISAs. Your child

can have one or both types in their name at any one

time, and we'll explain more about the rules around

these later in the article:

. Cash Junior ISA: A Junior Cash

ISA works like a regular adult Cash ISA. It’s

similar to a standard savings account, however, you

don’t pay tax on any interest you receive. In the

case of a JISA, the money is locked away and can’t

be withdrawn until your child turns 18.

. Stocks and Shares Junior ISA:

Like an adult Stocks and Shares ISA, this account

lets you invest in stocks, shares, bonds, and

investment funds. This means your returns are tied

to the performance of your investment portfolios,

rather than a set rate of interest.

Stocks and Shares ISAs usually offer higher returns

on your money than Cash ISAs, as your savings are

invested in the stock market. Instead of earning

money only through interest, gains from Stocks and

Shares ISAs also come from investment growth (i.e.,

how well your stocks and shares are performing).

However, that means that the value of your child's

investments can go down as well as up, unlike a Cash

ISA.

With a Stocks and Shares Junior ISA, you’re also in

complete control of your investment style. If you’re

interested in impact investing (i.e. investing in

sustainable and ethical projects and organisations),

this is a great choice. At APL, our funds are only

made up of companies actively making the world a

better place. That means you’ll know your child’s

JISA is doing good while you save for their future.

Whichever type of Junior ISA you choose, your child

won’t pay UK Income Tax or Capital Gains Tax on any

returns within the JISA limit.

How much can you invest in a JISA each year?

For the current 2023/24 tax year, the annual

Junior ISA allowance is £9,000. This means you

can only invest up to £9,000 in your child’s

account each year.

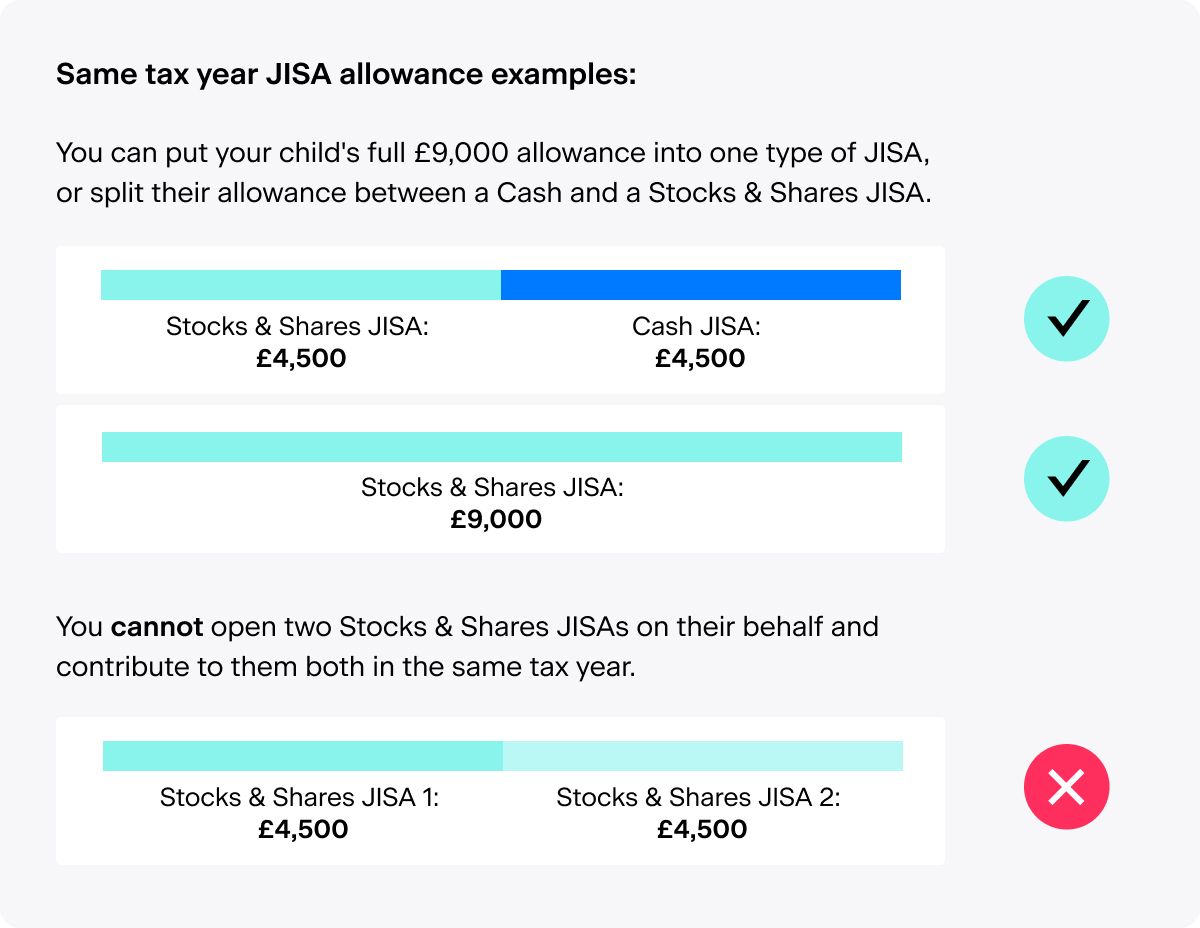

If you’ve opened both a Cash JISA and a Stocks

and Shares JISA, you can either pay the full

JISA allowance of £9,000 into just one of these

accounts or balance the amount between the two.

Here’s an example:

. In the 2023/24 tax year, you put £4,500

into your child’s Cash Junior ISA

. This means you can only put up to £4,500

into your child’s Stocks and Shares Junior

ISA in the same tax year.

. You'll then be at the Junior ISA limit

for the year (£9,000).

Will a JISA affect my own annual ISA

allowance?

As a parent or guardian paying into a

JISA, the £9,000 annual JISA allowance

doesn’t impact the amount you can put

into your ISA accounts.

Your annual ISA allowance will

remain at £20,000

(the upper limit for the current tax

year).

Who can get a Junior ISA?

To open a Junior ISA, your child must be:

. Under 18

. A UK resident

If your child isn’t resident in the UK, you can

only open a JISA for them if:

. You’re a crown servant (for instance, someone

working in diplomatic or overseas civil services, or

in the UK military).

. Your child depends on you for your care.

If your child moves abroad after you’ve opened their

Junior ISA, you (or other friends and family

members) can still add money to the account.

Just remember, the account is in the child’s

name, not yours. This means you can’t withdraw

money, but you’re still the responsible account

holder. This is known as a “registered

contact”.

Money in a JISA can’t be withdrawn until your

child’s 18th birthday. There are some

exceptional circumstances though.

If you have a Child Trust Fund (we’ll cover these in

more detail), you can’t have a JISA at the same

time. You’ll need to transfer your trust fund into a

JISA with your chosen provider.

Can I open a JISA for my grandchild?

You don’t have to be a child’s parent to open a JISA

on their behalf, but you do need to have parental

responsibility for them. So if you’re grandparents

or other legal guardians with overall

responsibility, you can open a JISA on the child's

behalf.

While you can’t open a JISA as a grandparent, you

can contribute to one once it’s open. All you have

to do is send money by bank transfer to the JISA

account.

Is it a good idea to transfer a JISA to a Child

Trust Fund?

JISAs and Child Trust Funds are reasonably similar,

but here are a few aspects to consider when deciding

if switching is right for you.

. JISAs are often easier to manage and can

offer more transparency.

With a JISA with APL, for example, you can see

exactly how much your child’s savings are worth. And

you can add money simply through our app.

. You have more control over your investing

style.

Junior Stocks and Shares ISAs are particularly

useful for ethical investing, giving you control

over which companies and funds your money supports.

That’s not usually possible with a CTF.

. JISAs may be more affordable.

JISAs normally offer lower fund manager charges and

fees than CTFs. This may not be the case for

everyone though, so check both your current and new

account fees before making any decisions. Transfer

fees might also apply when transferring from your

existing CTF.

. Both account types have the same tax

rules.

Both CTFs and JISAs have the same annual allowance

(letting you contribute up to £9,000 a year). Money

earned is also tax-free, including capital gains and

interest payments. So whichever account you go for,

you’ll enjoy the same tax benefits.

Save for your child’s future with a Junior ISA from

GLOBAL PORTFOLIO LTD

Ready to start saving for your child’s future? A

Junior ISA is a convenient and tax-efficient way to

put money aside for your child. You can add up to

£9,000 a year that they’ll be able to access once

they’ve reached the age of 18.

Sign up to GLOBAL PORTFOLIO LTD to open a JISA and

start saving for your child’s future today.